Tax will be compulsory subject in CBC, KRA

Source: Capital FM Kenya

Author: Ken Muthomi

NAIROBI, Kenya, Mar 20 - The Kenya Revenue Authority has formed an alliance with the Kenya Institute of Curriculum Development(KICD) for the development of exclusive tax e-resources for students in Competency-Based Curriculum (CBC) to enhance tax literacy among students.

In a statement, KRA stated that the program commenced with primary and secondary school students and will further progress to tertiary education.

The partnership will target learners in juniorand senior high schools, upper primary education, primary teacher trainees, secondary teacher education trainees, teacher trainees in early years education, learners in early years education, and the general public.

"This collaborative effort between KRA and KICD represents a commitment toenhancing tax literacy and fostering a culture of understanding and compliance with tax obligations," KRA statement read.

"Through accessible and innovative digital resources, theaim is to empower students and the broader public with the knowledge and skills to navigate the tax landscape effectively," it added.

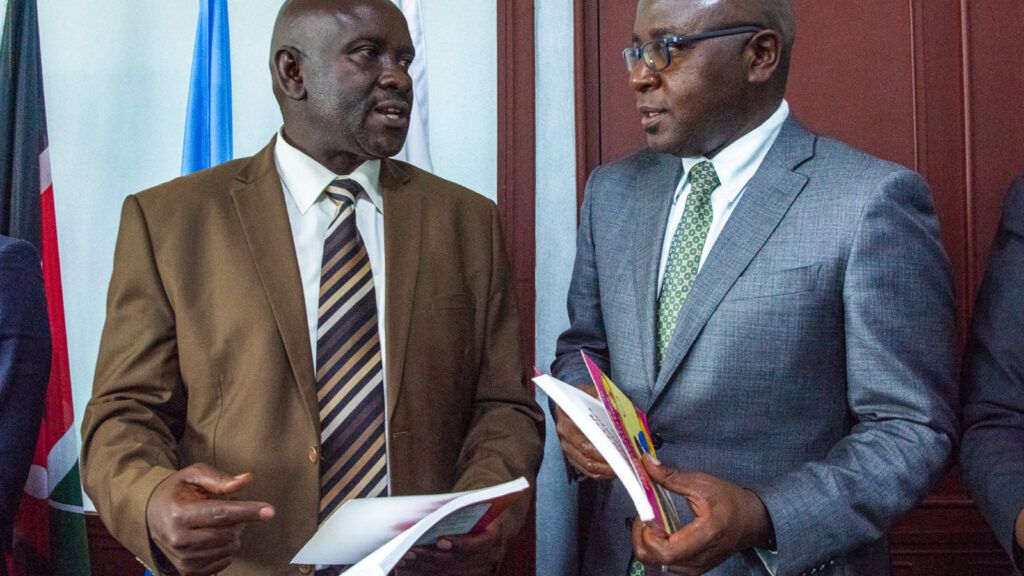

The KRA Commissioner General Humphrey Wattanga stressed the need to engage young people in tax literacy through the injection of such programs into the school curriculum, stating that this will be pivotal in ensuring the young generation evolves and becomes more informed and responsible on matters concerning taxes.

"By learning about taxes at an early age, students become more informed and responsible citizens," Wattanga added.

"Contributing to a long-term shift towards a society that values a fair and efficient tax system," he stated during an engagement with KICD leadership.

The Senior Deputy Director, TVET, Samuel Obudho, underscored the significance of the program, stating that it will be fundamental in ensuring that the tax body reaches a wider audience.

"This partnership provides an efficient platform for KRA to reach a wide audience," he stated.

Obudho further stressed that the pact will be significant in ensuring that the younger generation gets up-to-date tax literacy with digital content in a simulation environment that will positively influence learners attitudes towards tax.