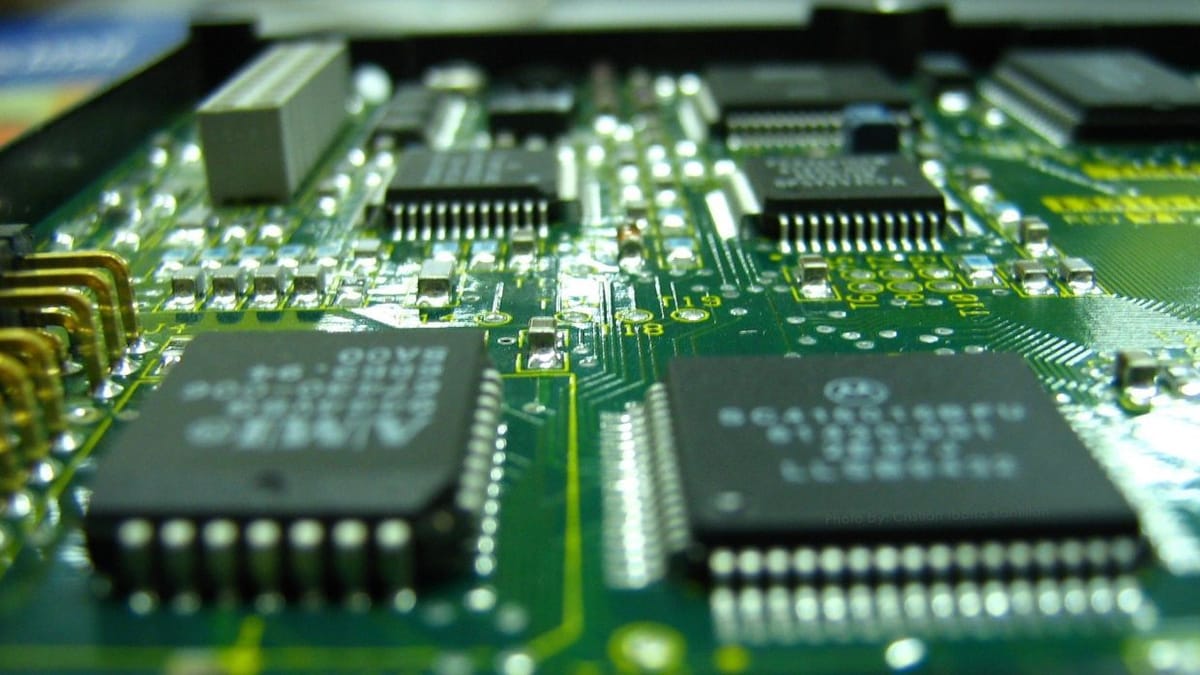

Semiconductor sector on a new upcycle

Source: The Star

PETALING JAYA: The semiconductor sector is seen to be on a rebound, with the pace of recovery expected to quicken in the second half of 2024 (2H24).

This followed the end of the downcycle that lasted through at least five quarters between 2022 and 2023.

According to RHB Research, the uptick seen in world semiconductor sales and the sustained recovery in the memory space are a signal of the onset of a new upcycle.

This trend is supported by the end of inventory correction and sturdier demand in the smartphone space and artificial intelligence (AI)-related applications, especially in China, the brokerage pointed out in its report yesterday.

In addition, it said, early recovery indications in the automated test equipment (ATE) space, along with traction in the front-end semiconductor space, bolstered its belief in a sustained sector recovery that is expected to gain pace in 2H24.

As such, RHB Research upgraded its technology sector call to "overweight" from "neutral".

"We advocate for investors to establish positions in the current early phase of the new semiconductor upcycle, as sector demand and earnings have bottomed," it said.

It noted that local ATE and outsourced semiconductor assembly and test companies were poised for recovery in the second half of 2024 and further growth into 2025, adding that valuation metrics should also improve with better growth visibility.

"We see opportunities in the small to mid-cap space, as the market has already factored in a slow first half of 2024," it said.

RHB Research noted that sector earnings had bottomed, with a year-on-year improvement expected on the back of various indicators, supported by its recent extensive channel checks.

"The recalibration of street expectations, coupled with the up-trending of KL Technology index despite consecutive lacklustre quarters, underscores this belief. In fact, many investors remain invested in the technology space despite several push-outs in the recovery.

"The pace of recovery across segments will be uneven, leading to variability in earnings performance. As such, agile trading strategies to navigate changing market dynamics are essential," it added.

RHB Research named Malaysian Pacific Industries Bhd and Unisem (M) Bhd as its top picks to benefit from the sector recovery, given their exposure to the growing demand for power management integrated circuits and diverse end applications.

"Besides, recovery in China's semiconductor space following two lacklustre years will help to boost their utilisation rate and economies of scale at their existing plants in China," the brokerage said.

It added that the companies could also benefit from US-China trade tensions, as their plants are in Malaysia, a neutral ground.

For non-semiconductor, RHB Research said it favoured CTOS Digital Bhd for the company's domestic-focused business, leading position and growth prospects from its various digital solutions, analytical insights and exposure to financial technology.

"The robust domestic economy, inbound tourist arrivals and various digitalisation initiatives to drive the private sector and small and medium enterprise space should continue to spur demand," it explained.