NCBFG extends APO closure date

Source: Trinidad Guardian

Jamaica's NCB Financial Group (NCBFG) announced on Friday that it will be extending its Additional Public Offering (APO) of shares in the group by one week.

The announcement came in a notice on the websites of the Jamaica and T&T stock exchanges, where NCBFG is listed.

The APO opened on May 6,and was originally scheduled to close tomorrow. The new deadline for the closure of the APO is June 3.

"The extension is in response to requests by potential investors for additional time and is intended to ensure the broadest possible participation of investors," said NCBFG in the notice.

The APO invited offers to acquire 78,500,000 new ordinary shares in NCBFG, with the ability to upsize the offer to a maximum of 117,750,000 shares.

The price of the offering is J$65 per share, which means the APO would gross J$5.09 billion (US$32.6 million) if it were fully subscribed. If the APO is upsized, it could gross J$7.65 billion (US$49 million).

Although NCBFG is cross-listed on the T&T Stock Exchange, the APO was not marketed to the T&T market.

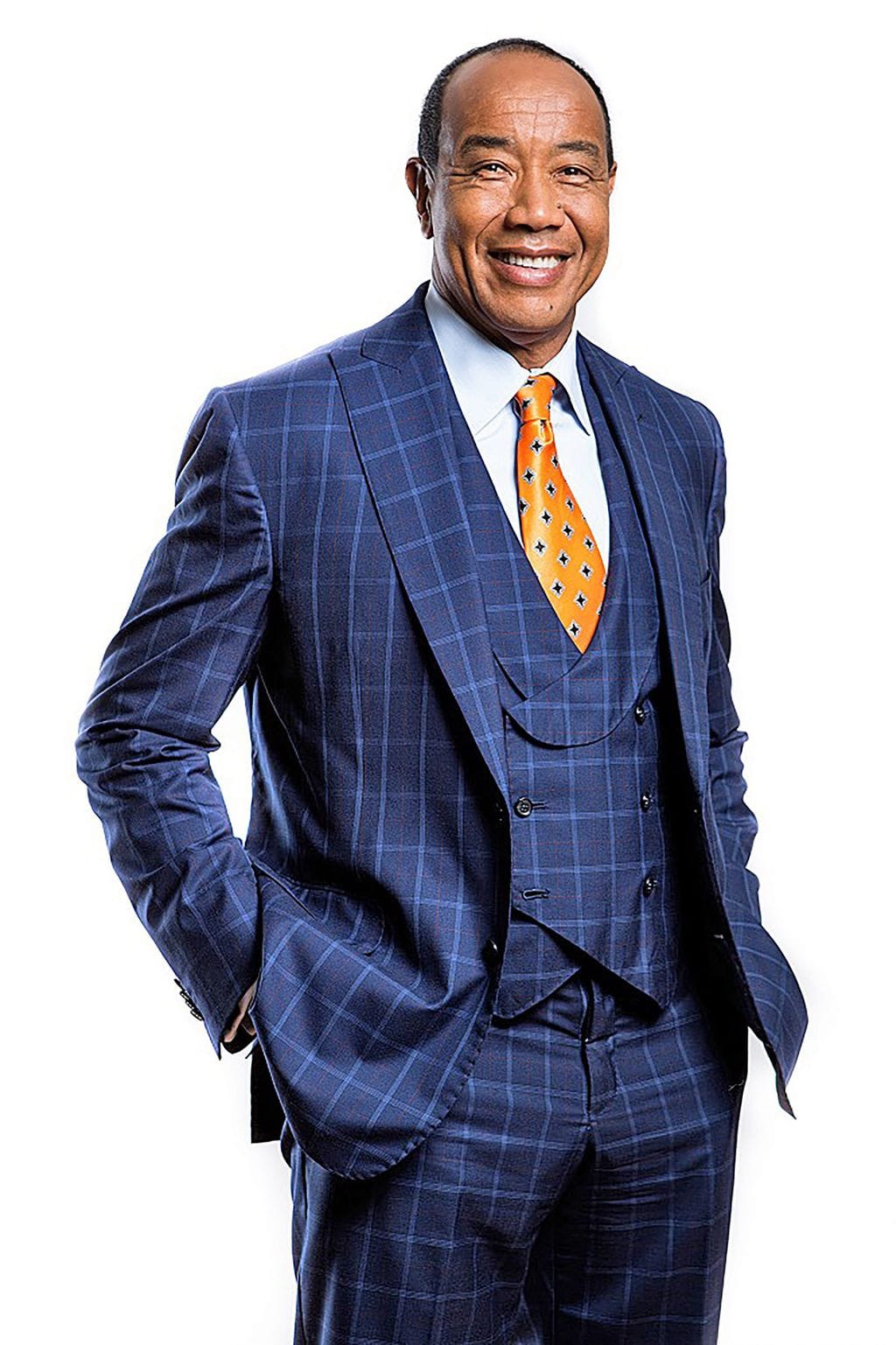

In a message to prospective investors in the prospectus of the APO, NCBFG chairman Michael Lee-Chin said one of the reasons for the offering is to reduce the levels of debt at the financial holding company.

"We intend to use the net proceeds from this invitation to support a part of our deliberate capital recalibration with a focus on deleveraging and bolstering capital bases," Lee-Chin wrote.

The Jamaica Observer reported on April 28: "NCBFG, the stand-alone holding company, currently has $36.84 billion (US$23.61 million) in debt due between October 1, 2023, and September 30, 2024, relative to its total debt load of $93.51 billion (US$59.94 billion)."

In its May 9 report of its unaudited financials, NCBFG recorded J$8.65 billion in net profit attributable to shareholders of the company for the six months ended March 31, 2024. That is an improvement of 88.8 per cent compared to the six months ending March 31, 2023.